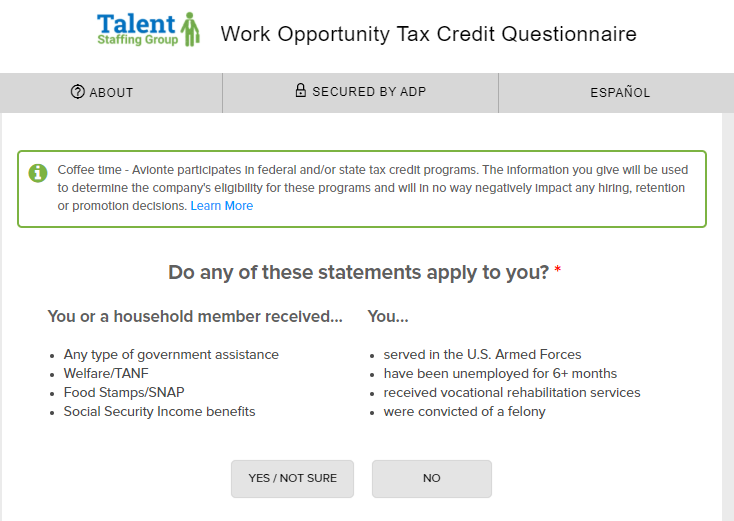

work opportunity tax credit questionnaire required

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers rewarding them for every new hire who meets eligibility requirements. The work opportunity tax credit WOTC is available for eligible employers who hire employees from certain targeted groups.

116-260 -- Consolidated Appropriations Act 2021.

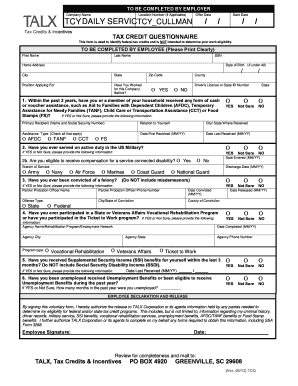

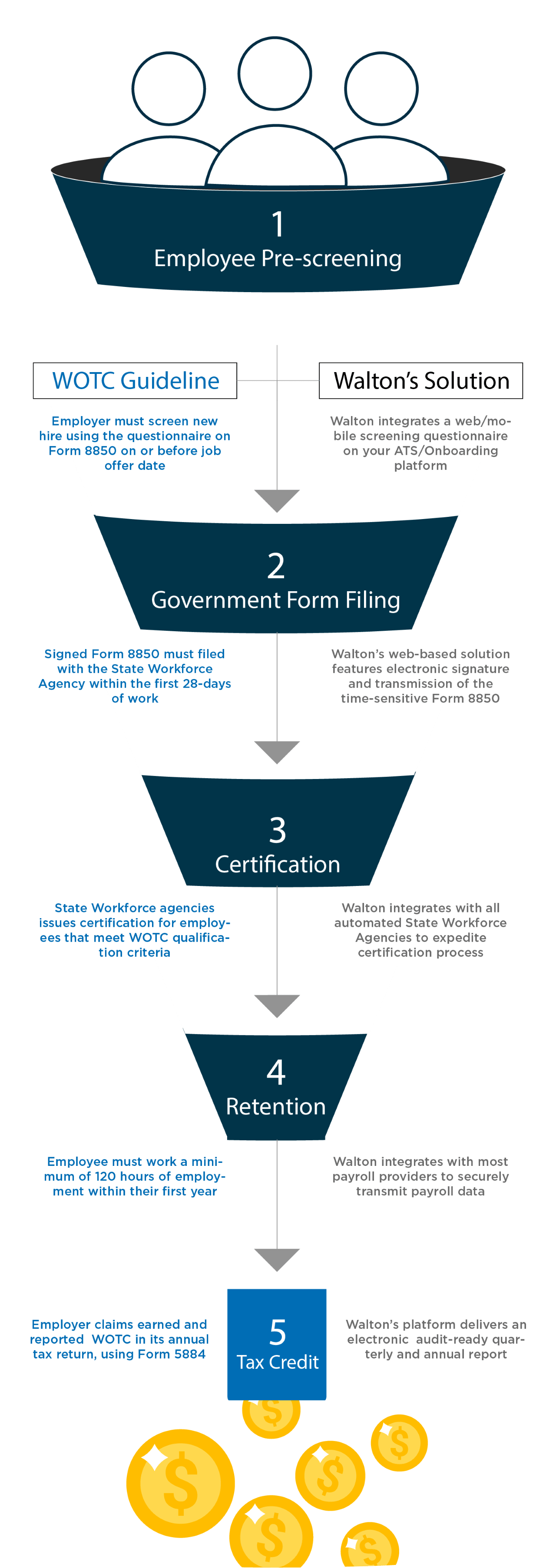

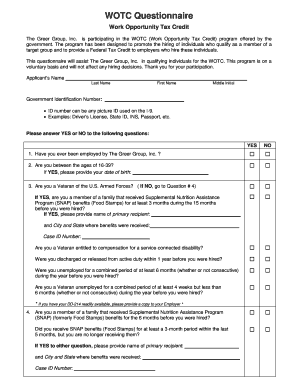

. It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions. Enter the required information. Employers use Form 8850 to pre-screen and to make a written request to their state workforce agency SWA to certify an individual as a member of a targeted group for purposes of qualifying for the work opportunity credit.

In the case of the above question the sender did not provide their email address so we were unable to reply directly to them. Californias electronic WOTC eWOTC application process is a paperless alternative to the original WOTC application process which requires employers to mail the IRS Form 8850 and Department of Labor DOL Individual Characteristics Form ICF 9061 and any supporting documentation to their State Workforce Agency. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc.

A date older than 130 years. An eligible employer must file Form 8850 Pre-Screening Notice and Certification Request for the Work Opportunity Credit with their respective state workforce agency within 28 days after the eligible wo. A date in the future.

A different maximum credit calculation may apply. The state work opportunity tax credit wotc coordinator for the swa must certify the job applicant is a member of a targeted group. Select the Tax Credit Check task.

Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires to determine if they are eligible for a tax credit for hiring that person. Available ranges from. WOTC is truly a win-win program.

If youre interested in taking advantage of the WOTC its important to know. A person becomes eligible when they meet the requirements of belonging to one of the target groups of people that includes Veterans people who have been. Employers can claim tax credits each year for each employee they hire in this demographic.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who hire people in certain target demographics who often experience employment barriers. At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website. The answers are not supposed to give preference to applicants.

The Work Opportunity Tax Credit WOTCan incentive for employers to broaden their job applicant pools and hire from certain groups of people who may need assistance finding jobs. The job seeker or the employer must complete the Individual Characteristics Form Work Opportunity Tax Credit ETA 9061. Page one of Form 8850 is the WOTC questionnaire.

The program has been designed to promote the hiring of individuals who qualify as a member of a target group and to provide a Federal Tax Credit to employers who hire these individuals. The data is only used if you are hired. Many organizations are hiring WOTC-eligible employees but arent taking full advantage of the federal tax credits.

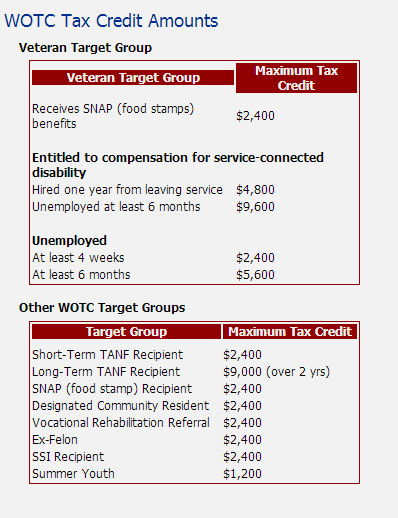

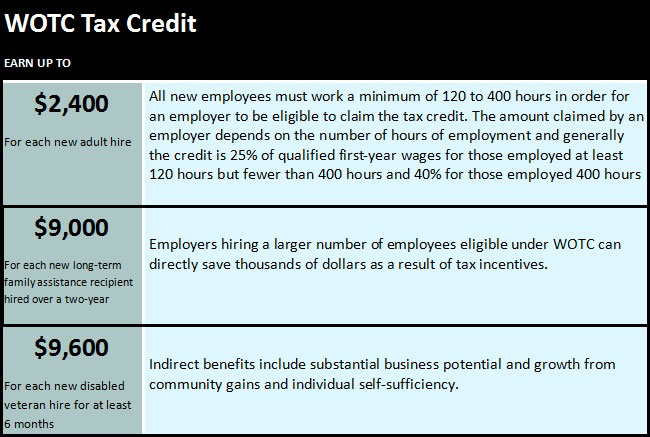

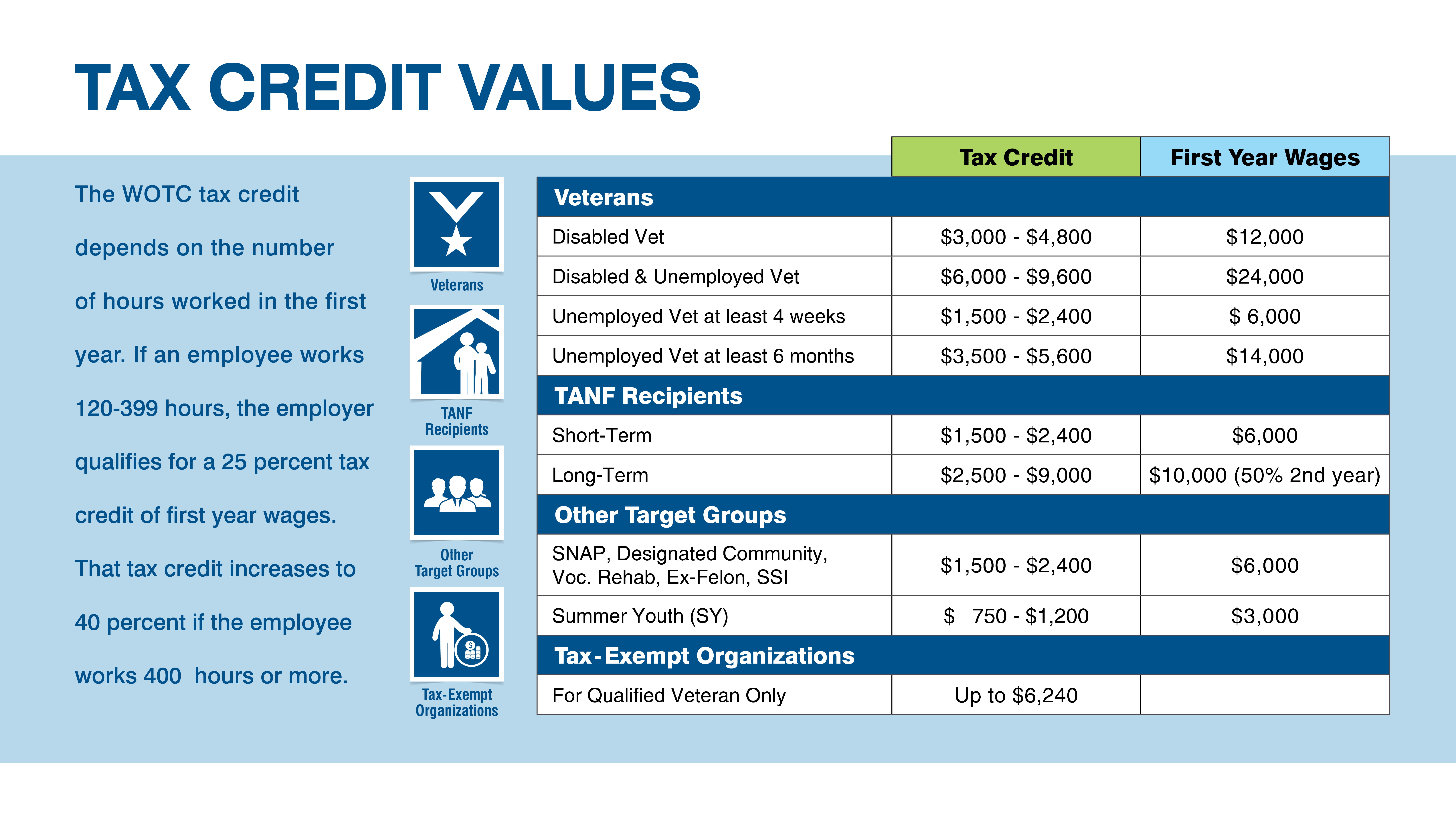

The WOTC program not only creates a positive impact on the nations unemployment levels but also affords business owners the incredible opportunity to earn between 2400 and 9600 for each eligible new hire. Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program created by the US. After the required certification is secured taxable employers claim the WOTC as a general business credit against their income taxes and tax-exempt employers claim the WOTC against their payroll taxes.

The WOTC Questionnaire asks questions that are not visible to the hiring managers or hr except admins that control the data flow. Download our printable. The Work Opportunity Tax Credit is calculated as 40 of first-year eligible wages up to a maximum of 6000 per employee.

Employees who may have a difficult time finding a job gain employment and employers who hire them are eligible for federal tax credits up to 9600 per eligible employee. Employers use Form 8850 to make a written request to their SWA to certify someone for the work opportunity credit. If the employee completed at least 120 hours but less than 400 hours of service for the employer the Work Opportunity Tax Credit is up to 25 of first-year eligible wages.

Is participating in the WOTC program offered by the government. The employer and the job seeker must complete the Pre-Screening Notice and Certification Request for the Work Opportunity Tax Credits IRS Form 8850 and sign under penalty of perjury attesting that the job seeker is a member of a target group. This is the Ernst Youngs vendor survey site.

The WOTC survey displays in the current browser window. Work Opportunity Tax Credit questionnaire. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

BENEFITS TO EMPLOYERS. The Date of Birth DOB field does not allow. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow.

The forms must be submitted no later. Secured taxable employers claim the WOTC as a general business credit against their income taxes and tax-exempt employers claim the WOTC against their payroll taxes. Completing Your WOTC Questionnaire.

9600 depending on the targeted group and qualified wages paid to the new employee generally during the first year of. An employer must obtain certification that an individual is a member of the targeted group before the employer may claim the credit. As soon as the person is hired you must submit Form 8850 and Form 9061 to the state workforce or employment agency for a determination on the eligibility of this worker for WOTC credit.

Are employees required to fill out WOTC form. These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction. However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits.

It is legal and you can google it. Below you will find the steps to complete the WOTC both ways. Employers must meet pre-screening and certification requirements to.

WOTC is authorized until December 31 2025 Section 113 of Division EE of PL. Work opportunity tax credit questionnaire page one of form 8850 is the wotc questionnaire.

What S The Work Opportunity Tax Credit Wotc Program Overview Cti

Work Opportunity Tax Credit Department Of Labor Employment

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit First Advantage

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Wotc Hiring Credits Work Opportunity Tax Credit Comprehensive Guide Emptech Com

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Wotc Hiring Credits Work Opportunity Tax Credit Comprehensive Guide Emptech Com

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

What You Need To Know About Work Opportunity Tax Credits Wotc Applicantpro

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1144541711-111b0ab2182848498ec783fa6d5bbd35-b749d033009a41a2903348e46f7bde60.jpg)

How Does The Work Opportunity Tax Credit Work

Work Opportunity Tax Credits Wotc Walton

Leo Work Opportunity Tax Credit

Cost Management Services Work Opportunity Tax Credits Experts Wotc Processing And Tax Credit Experts Weknowwotc

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller